Protectionism Doesn’t Pay

Contemporary American trade restrictionists are essentially expressing a modern version of mercantilism.

Reprinted with Permission from The Next American Economy: Nation, State, and Markets in an Uncertain World, by Samuel Gregg, published by Encounter Books. @ 2022 by Encounter Books. All rights reserved.

Apart from slavery, few subjects divided Americans more consistently during the nineteenth century than tariffs. Disagreements about their scope and effects even helped precipitate a major constitutional clash. The passage of the Tariff of 1828 and the Tariff of 1832 led to the Nullification Crisis, whereby South Carolina’s claim that it could prohibit enforcement of these tariff acts within its boundaries led to President Andrew Jackson threatening to deploy federal troops to enforce federal law.

Americans as a whole have never been isolationists when it comes to trade. But ever since Adam Smith assailed what he called “the mercantile system,” which dominated trade throughout the 18th-century world, those responsible for ordering trade relations between America and other countries had to consider whether they would levy duties on imports entering America and at what rate.

The first tariffs imposed by the federal government on imports into America via the Tariff Act of July 4, 1789, were primarily understood as a tax by which the government could raise revenue to cover its expenses and service the country’s debts. Likewise, tariff increases throughout the 1790s were first and foremost directed to funding government operations and reducing the national debt rather than establishing an out-and-out protectionist trade regime. Throughout the nineteenth century, however, protectionist policies became central to debates about the government’s economic role. Divisions of opinion among Americans on this topic often reflected the industry prevailing in different parts of the country. The most notable were between much of the North and many in the South before and after the Civil War. Article I, Section 8 (1) of the Confederate States of America 1861 Constitution even specified: “nor shall any duties or taxes on importations from foreign nations be laid to promote or foster any branch of industry.”

This effort to constitutionally prohibit protectionist policies reflected the desire of many Southern states to ensure that their cotton exports did not find themselves subject to retaliatory tariffs levied by European nations. By contrast, many Northern industrial interests viewed tariffs as a way to make the costs of buying imported goods from their foreign competitors more expensive for Americans than they would otherwise be. These Northern interests generally got their way after the Civil War. Many temporary duties on foreign imports to help pay for the war became permanent for decades afterwards.

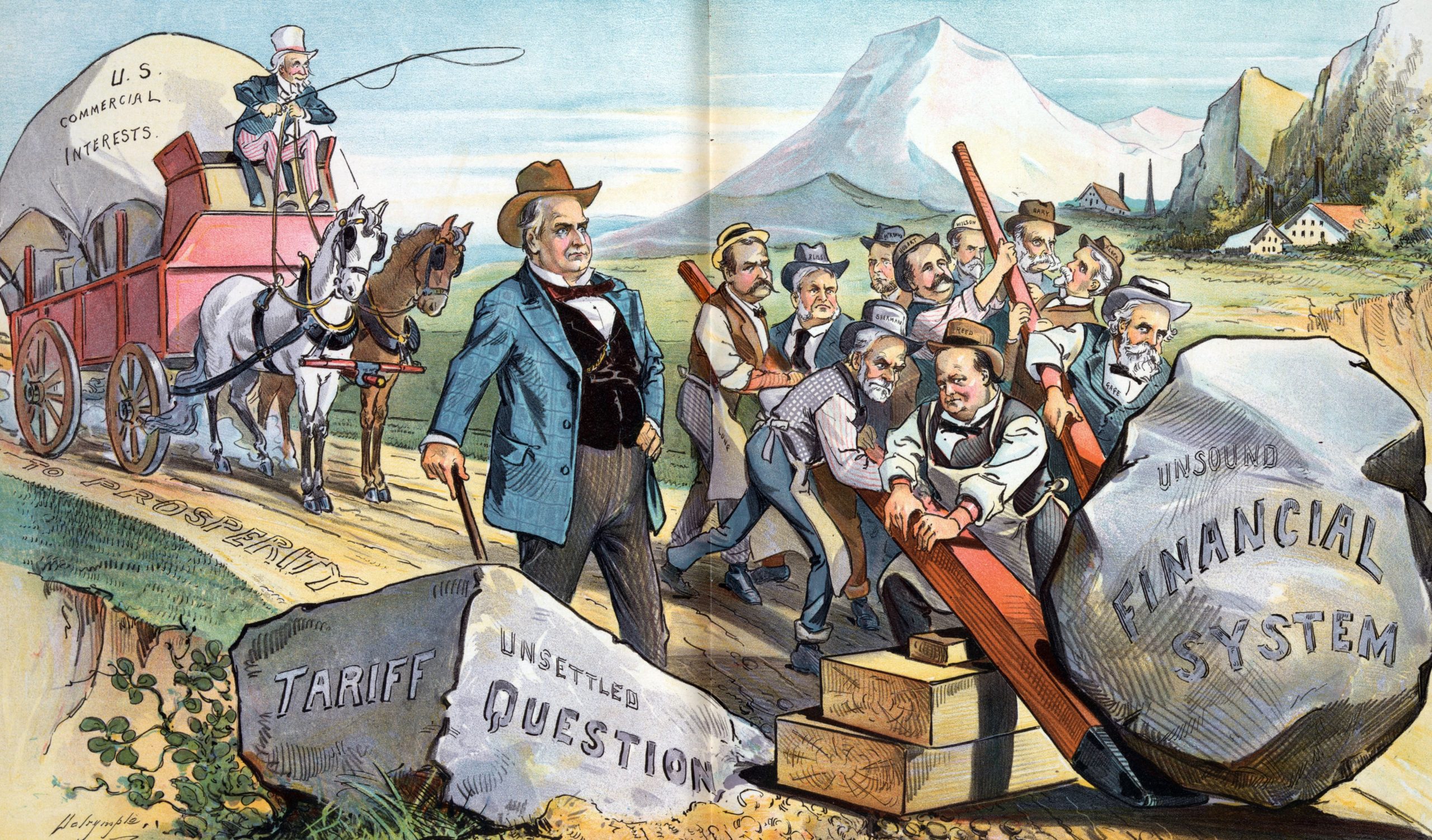

Postbellum America’s embrace of protectionism achieved a type of apotheosis during the presidency of William McKinley (1843–1901). McKinley portrayed himself as “a tariff man standing on a tariff platform.” Significantly, he opposed tariffs imposed purely for revenue purposes. Protectionism, McKinley argued, was about giving American businesses a price advantage in American domestic markets when competing with foreign-made goods. That, McKinley held, was the path to American prosperity. Many legislators agreed and supported the McKinley Act of 1890. It raised the average tariff on imports from 38 percent to approximately 49.5 percent.

McKinley was fully aware that tariffs meant that the federal government was actively choosing to favor some sectors of the economy over others and requiring millions of American consumers to absorb the costs. For that is what tariffs do. Protectionists who acknowledge this point maintain that the price is worth it. Most scholars who promote protectionist policies today hold that such measures are needed to preserve American manufacturing, provide space and time for new industries to take off in America, inhibit the reduction of American wages, and help American businesses compete against foreign companies. Such things, they argue, are in America’s national interest. By contrast, free trade is portrayed as subjecting American businesses and workers to unfair competition from abroad. Some further insist that the very idea of free trade is a myth insofar as no country will ever engage in unilateral free trade. Why then should America not deploy tariffs and import controls like everyone else?

My answer to that question is that America should avoid projectionist policies as much as possible because they do not serve the common good of Americans as consumers, workers, or as a nation. Not only are protectionist arguments characterized by mistaken logic and a confusion of cause and effect; there is also a great deal of empirical research indicating how protectionism undermines America’s long-term economic interests and international competitiveness, and how it breeds some of the worst and most lasting forms of cronyism. Such critiques of protectionism are not new. They were first outlined in detail in Book IV of Adam Smith’s Wealth of Nations.

Of all the blows dealt by Smith’s Wealth of Nations, perhaps the most comprehensive was to mercantilism: an economic system that embodied various features characteristic of modern protectionism, such as the idea that any country’s trade policy should focus on maximizing its exports and minimizing its imports. The more you minimize imports, it was argued, the more a country retains its wealth, especially in the form of gold and silver. Efforts were consequently made to discourage imports and boost exports via the government levying heavy duties upon foreign imports, trying to increase output and exports by subsidizing existing domestic industries, constraining laborers’ ability to migrate in pursuit of new opportunities, and often outlawing technology transfers that might intensify competition from abroad.

Smith found these arguments wanting. He pointed out that mercantilist efforts to protect domestic industries didn’t increase a country’s total output. No regulation, Smith stated, “can increase the quantity of industry in any country beyond what its capital can maintain.” Instead, regulation diverted part of a country’s capital “into a direction into which it might not otherwise have gone.” But, Smith added, “it was by no means certain that this artificial direction is likely to be more advantageous to the society than that into which it would have gone of its own accord.” These words were echoed by James Madison speaking thirteen years later during the first Congressional debates about tariffs: “It is also a truth,” he observed, “that if industry and labor are left to take their own course, they will generally be directed to those objects which are the most productive, and this is a more certain and direct manner than the wisdom of the most enlightened legislature could point out.”

Smith’s wider point is that tariffs do not inherently increase production. Output is driven by factors such as efficiency, specialization, and the amount of capital invested in a given business or industry. The only thing that tariffs can do is encourage businesses to shift their investments elsewhere, and there is no way of knowing in advance if this will increase output.

Smith’s more general problem with mercantilism’s restricting or penalizing imports is that it reflected a mistaken apprehension of the purpose of economic production. The point of production was not to maintain production itself. Production was a means to an end. And the goal of production—of economic life as a whole—is consumption. We don’t consume goods and services to promote production. Production is supposed to satisfy the needs and wants of consumers. “Consumption,” Smith wrote, “is the sole end and purpose of production; and the interest of the producer ought to be attended to only so far as it may be necessary for promoting that of the consumer.” The problem, he stressed, with “the mercantile system [is that] the interest of the consumer is almost constantly sacrificed to that of the producer; and it seems to consider production, and not consumption, as the ultimate end and object of all industry and commerce.”

If, however, this point was so obvious, why did so many countries prioritize the interests of a minority (some producers) over those of everyone else (consumers)? One answer, Smith said, lay in the ability of such producers to exert disproportionate influence over trade policy:

It cannot be very difficult to determine who have been the contrivers of this whole mercantile system; not the consumers, we may believe, whose interest has been entirely neglected; but the producers, whose interests has been so carefully attended to.

In a letter written in 1783, Smith doubled down on this point: “every extraordinary, either encouragement or discouragement that is given to the trade of any country more than to that of another may, I think, be demonstrated to be in every case a complete piece of dupery, by which the interest of the state and the nation is constantly sacrificed to that of some particular class of traders.” The injustice didn’t end there. Smith recognized that mercantilism was premised upon close collusion between particular merchants and government officials. The losers from these arrangements included merchants without political connections and consumers who had no choice but to pay higher prices for often lower quality goods and services. The same criticisms are applicable to the arguments for increased protectionism in America today. To be a protectionist is, I submit, to prioritize sectional interests over the national interest.

In the second half of the nineteenth century, America eclipsed Britain as the world’s biggest economy. This was a time in which protectionist measures were a major feature of American trade policy. Some consequently argue that these policies played a major role in America’s emergence as an economic superpower between 1776 and 1890.

There is, however, widespread evidence that protectionist policies actually impeded America’s march to economic greatness. Douglas A. Irwin’s extensive analysis of the late nineteenth century American economy indicates that growth during these decades was driven primarily by population growth, capital accumulation, and entrepreneurship, rather than the productivity improvements that come from nations pursuing something crucial for free trade, i.e., comparative advantage.

Comparative advantage concerns the ability of an individual, business, or nation to produce a particular good or service at a lower opportunity cost (the potential benefits that we miss out on by choosing one alternative over another) than its competitors and trading partners. Exposure to the pressures of domestic and foreign competition plays a major role in helping nations discover and develop their comparative advantage. Nations learn what they do comparatively better and more efficiently than others. Protectionism, by contrast, gradually dulls our awareness of our comparative advantages and opportunities to pursue it. Tariffs, subsidies, and import quotas seek to offset foreign competition’s impact on a given industry—and may even succeed for a time. But such measures also discourage that industry from adapting and becoming more efficient. The more you protect an industry, the more inflexible and inefficient it will likely become.

Not coincidentally, Irwin points out, productivity growth was more rapid in those sectors of the nineteenth-century U.S. economy whose performance was not directly connected to the tariff. Irwin’s analysis is confirmed by economist J. Bradford DeLong’s major study of America’s post-Civil War economy. DeLong determined that protectionism weakened the gains made by America through technological innovation. The artificially high price of imported capital goods generated by protectionism made it harder and more expensive to build America’s transportation and industrial infrastructure. From this perspective, America’s economic success throughout the nineteenth century occurred despite protectionist policies.

In 1945, American trade policy took a different turn. America and many other nations established the General Agreement on Tariffs and Trade to promote a multilateral liberalization of trade across the globe. In 1947, average tariffs of industrial countries were about 40 percent. By 2021, the trade-weighted average tariff rate applied by America was 2.4 percent.

Compared to the post-Civil War period, this is a dramatically lower number. But it is not the whole story. The duty applied to almost 37 percent of tariff lines for imports in 2021, for example, was zero. Yet 5 percent of the lines in America’s tariff schedule exceeded a 15 percent duty that same year. Nor are tariffs the only form of protectionism. America imposes quotas upon many imported goods. Likewise, more than 2,300 non-tariff barriers (product standards, health requirements, etc.) were applied to many products entering America in 2022.

Further muddying the waters is the willingness of presidential administrations to deploy protectionist measures to respond to particular problems, such as downturns in particular industries or tariffs imposed by foreign governments upon U.S. exports to other countries. In March 2002, for instance, the Bush administration slapped tariffs ranging between 8 and 30 percent on steel imports. These were designed to counter what the steel industry insisted was a surge of steel imports into America that were making it harder for American steel producers to compete. Seven years later, the Obama administration imposed new tariffs on truck and car tires imported from China for a three-year period.

The United States may have a low average tariff level, but this disguises the many ways in which protectionism still affects America’s economy. That is all the more reason to understand why the arguments for protectionism are just as fallacious as those advanced by the eighteenth-century mercantilists confronted by Adam Smith.

A common argument advanced by protectionists is that postwar trade liberalization has resulted in America importing more goods than it exports. Imports are seen as “costs” to the economy while exports are understood as “benefits.” On this basis, Wilbur Ross, secretary of commerce from 2017 to 2021, argued that imports amount to a reduction of GDP. “It’s Econ 101,” he wrote, “that GDP equals the sum of domestic economic activity plus ‘net exports,’ i.e., exports minus imports.” Ross subsequently concluded that when America runs trade deficits, its economy becomes weaker. Trade policy should therefore, he held, focus on reducing imports so that America’s GDP could grow.

This, however, is not Econ 101. It’s bad economics. The reason why GDP calculations typically subtract imports is to ensure that we have a more accurate grasp of what is being produced domestically. It’s no indication that America and Americans are becoming poorer. Many goods made in America would not be produced in the first place (or would be created at a much higher price) without foreign imports.

What’s important to grasp here is that contemporary American protectionists are essentially expressing a modern version of the mercantilist assertion that you “win” by exporting more than you import. This is expressed through their treatment of what’s called “the balance of trade.” In simple terms, the balance of trade is the difference between a country’s total exports and its total imports of goods and services. When a nation exports more than it imports, protectionists see this as positive because foreigners are buying American-produced goods and services. America thus “wins.” The opposite—when imports exceed exports—is regarded as negative because America is taking in more than it sends abroad. To run a trade deficit therefore means that America is “losing.”

This way of thinking is to understand trade precisely the wrong way around. The entire concept of a balance of trade is highly problematic. As Adam Smith wrote, “Nothing, however, can be more absurd than this whole doctrine of the balance of trade, upon which, not only these restraints, but almost all the other regulations of commerce are founded.” Smith’s insight is that when individuals and businesses enter into a free exchange within a country or between countries, they both “win” to varying degrees. Otherwise, neither would have agreed to the exchange in the first place. To the extent that protectionism makes it more costly for America to import goods and services from abroad, the benefits received from these exchanges are reduced.

Placing extra costs on Americans’ freedom to import goods and services is only the first of many problems with protectionist policies. At its most basic level, protectionism increases the price that Americans would otherwise pay for goods and services. From this, there are two sets of losers.

The first are everyday American consumers. It is they, not foreign companies, who pay for the costs of tariffs. Wealthy Americans can easily absorb the increased costs. But the less-well off bear a proportionately larger burden as their increased costs are paid out of their much smaller resources. The second group of losers are American businesses forced to pay higher prices for various products than they otherwise would. That increases their production costs. Very large companies might be able to handle this without too much fuss. Smaller and medium-sized businesses are more likely to experience difficulty. They often absorb the cost by raising prices for consumers or reducing their employee numbers.

This is precisely what occurred when the Trump administration increased tariffs on steel and aluminum imports in March 2018. A Federal Reserve analysis of the impact of these increases released in December 2019 estimated that, on balance, these tariffs resulted in a net loss of approximately 75,000 jobs, the majority of which were blue-collar jobs located in mostly blue-collar towns. The reason, Douglas Irwin points out, is that “many more workers are employed in steel-using industries than in the steel industry itself. Higher steel prices penalized domestic producers of steel-intensive products, such as farm equipment and machinery, harming their competitive position in domestic and foreign markets (by reducing their exports and increasing other imports).”

Subscribe Today

Get daily emails in your inbox

Though some protectionists may acknowledge that tariffs hurt American businesses and consumers, they maintain that the federal government can use them when trying to cajole other countries into opening their markets. Adam Smith, they note, agreed that tariffs might be justified as a way of pressuring other nations to reduce their tariffs. But those invoking Smith here are slower to acknowledge that he held that this was usually an unwise policy to follow. Smith maintained that the legislator implementing such a policy was likely to be an “insidious and crafty animal” dominated by short-term considerations; those who would suffer the high costs of retaliatory tariffs were seldom the same as those implementing the tariffs.

The Smoot-Hawley 1930 Tariff Act underscores the folly of going down this path. Initially, Smoot-Hawley appeared to have a positive net-impact throughout America. Industrial production increased sharply, as did construction contracts and factory payrolls. Irwin’s study of Smoot-Hawley’s effects, however, demonstrates that raising tariffs on more than 20,000 imports provoked significant retaliation against America from across the globe. This reduced U.S. exports and contributed to America’s share of overall world trade dropping in the 1930s. That eventually translated into businesses—and the jobs they provided—downsizing or disappearing altogether at a time when America could ill-afford such developments.

Reprinted with Permission from The Next American Economy: Nation, State, and Markets in an Uncertain World, by Samuel Gregg, published by Encounter Books. @ 2022 by Encounter Books. All rights reserved.